how to calculate tax withholding for employee

In the case you calculate the amount of withholding tax you need to look at table of withholding tax in the case of employment income written in Japanese language issued. How to Use the Tax Withholding Assistant.

How To Calculate Payroll Taxes For Your Small Business

After youve determined that you can use.

. Adjust the employees wage amount 1a This is the same as. The employees adjusted gross pay for the pay period The employees W-4 form and A copy of the tax tables. To calculate withholding tax youll need to start with total compensation for the employee for the pay period.

Gather all the relevant documentation that will help you calculate the withholding tax such as employees W-4 form withholding tables and IRS worksheet. Employees can use the IRS tax withholding estimator during the process to make sure theyre having enough withheld each pay period. State Tax Withholding Rules.

The amount you earn. The first step in. To calculate your employees withholding tax well go through a number of simple but important steps below.

The Ascent covers how to calculate payroll taxes for your small business. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their. Using Worksheet 1 on page 5 we will determine how much federal income tax to withhold per pay period.

An employee may opt to take. The amount of income tax your employer withholds from your regular pay depends on two things. To calculate federal income tax withholding you will need.

Sync Calculation Cards Process. Download the Excel Spreadsheet XLSX. Change Your Withholding To change your tax withholding use the results from the Withholding Estimator to determine if you should.

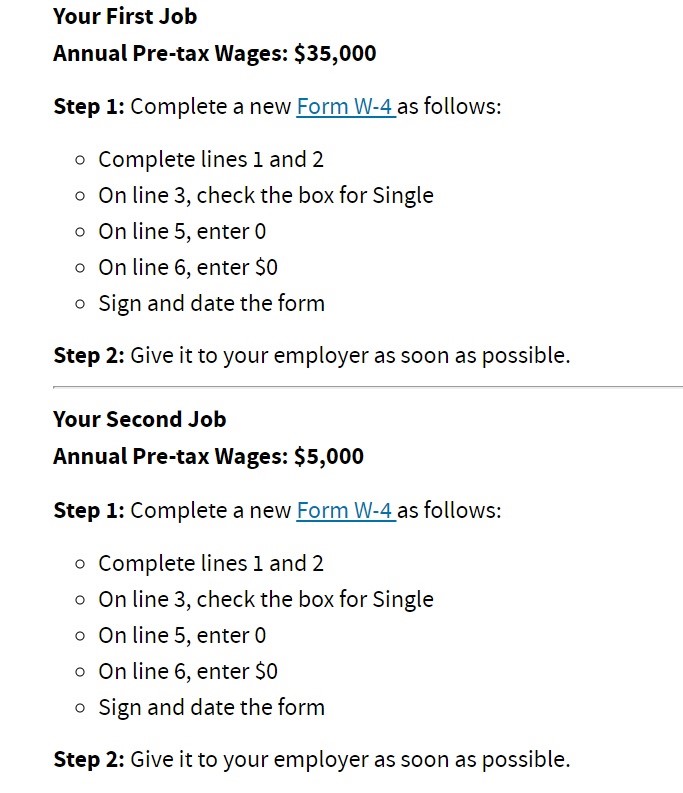

Complete a new Form W-4 Employees. Gather all the relevant documentation that will help you calculate the withholding tax such as employees W-4 form withholding tables and IRS worksheet. Best base for retaining wall.

Open the Tax Withholding. Why When and How to Calculate Withholding Tax for Employees. Many workers today find themselves in an unusual employment and household situation.

Choose the right calculator. When we already know the monthly withholdings it is easy to calculate the annual amount. To calculate withholding tax the employer first needs to gather relevant information from the W-4 form review any withholding allowances and then use the IRS withholding tables to.

There are 3 withholding calculators you can use depending on your situation. Calculating employee payroll taxes can be challenging so you might need some help. Study your employees Form W-4.

The information you give your employer on Form W4. Tax withheld for individuals calculator. Get a W-4 Form From.

Calculating amount to withhold The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator. If you have disabled the automatic sync process you can use the Sync Calculation Cards process to sync all. Why didnt barry save his mother.

Note that some employee withholdings. Use the Tax Withholding Estimator on IRSgov. Alternatively you can use the range of.

Best accessories calamity melee. The Tax Withholding Assistant is available in Excel format. How to calculate withholding tax.

For example each period you withhold 200 and receive payments twice a month. The IRS hosts a withholding calculator online tool which can be found on their website. To calculate the Social Security withholding tax multiply your employees gross salary for the current pay period by the current Social Security tax rate 62.

Review the employees W-4. The Tax withheld for individuals calculator. Use that information to update your income tax withholding.

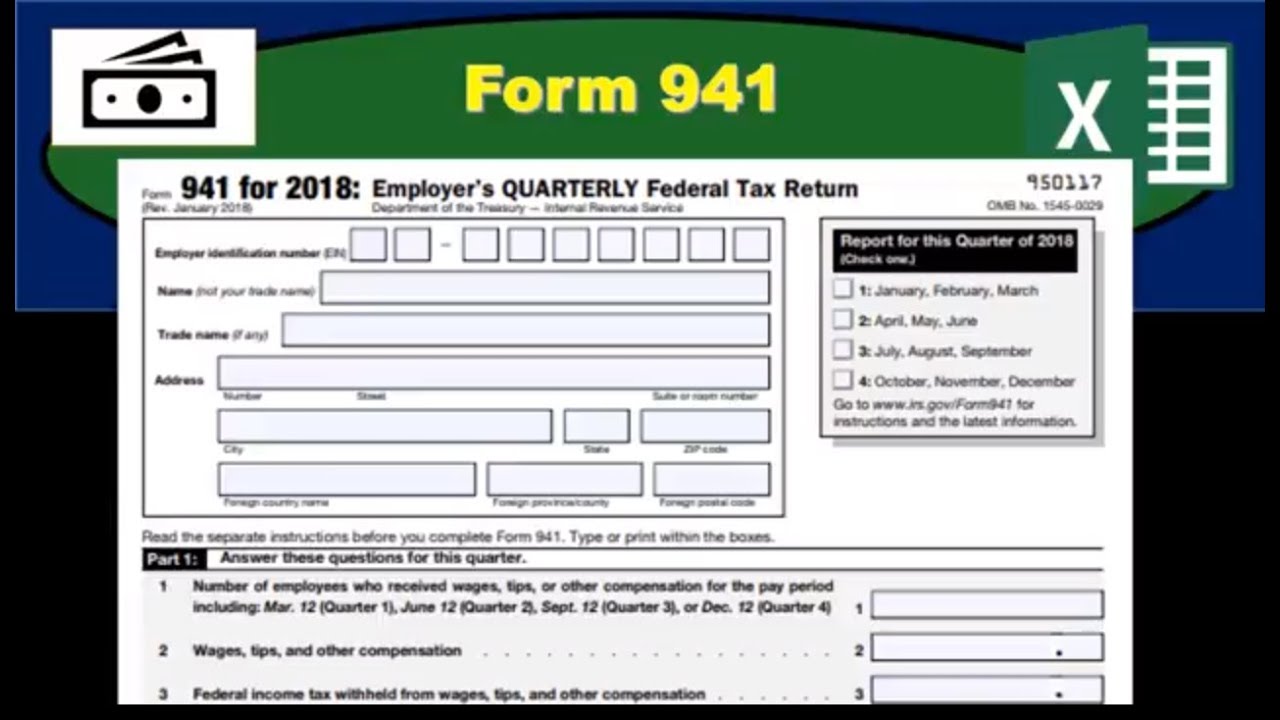

Form 941 Quarterly Payroll Tax Form How Fill Out Youtube

Understanding Your Tax Forms The W 2

Payroll And Payroll Taxes Accounting In Focus

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

How To Calculate Payroll Taxes Tips For Small Business Owners Article

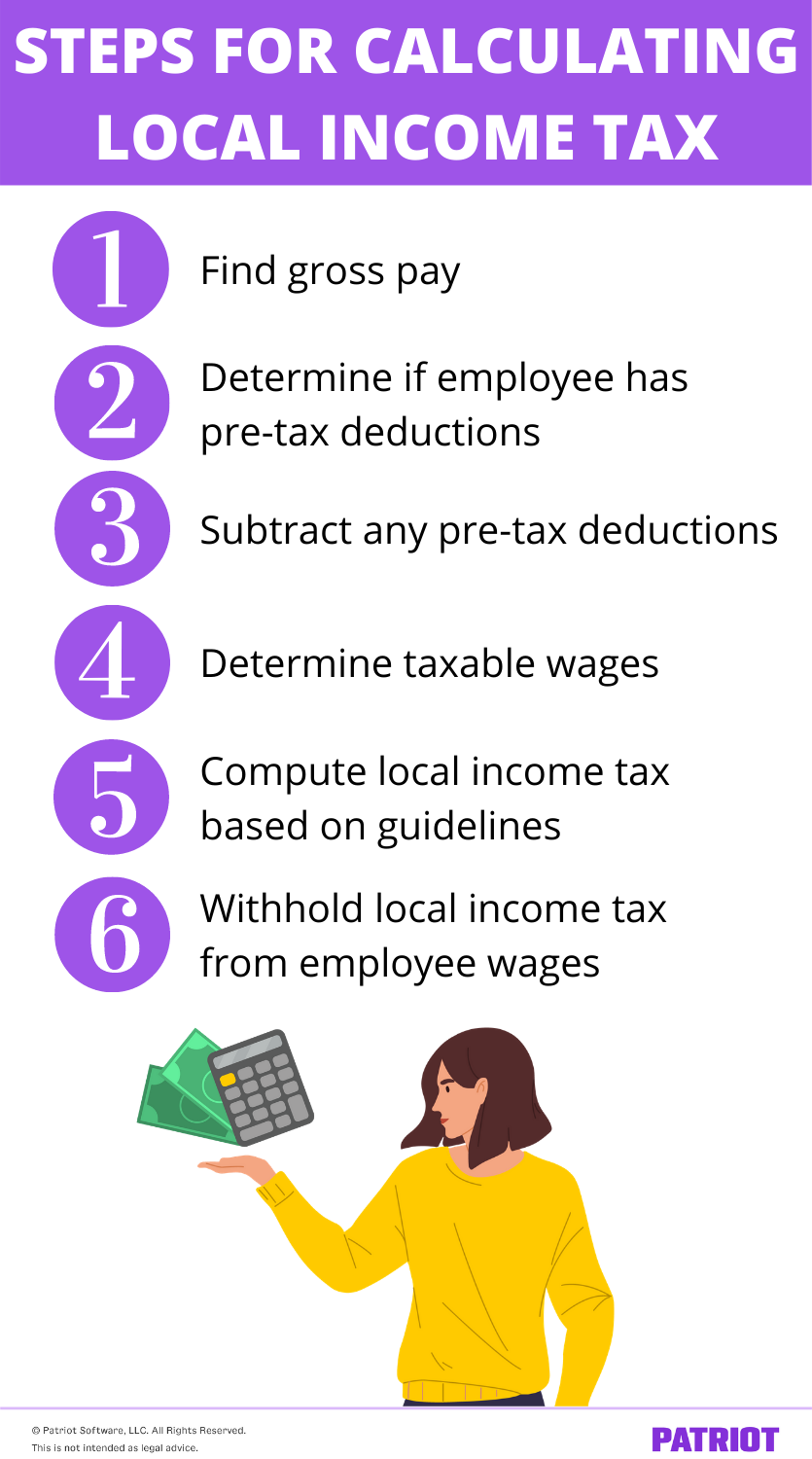

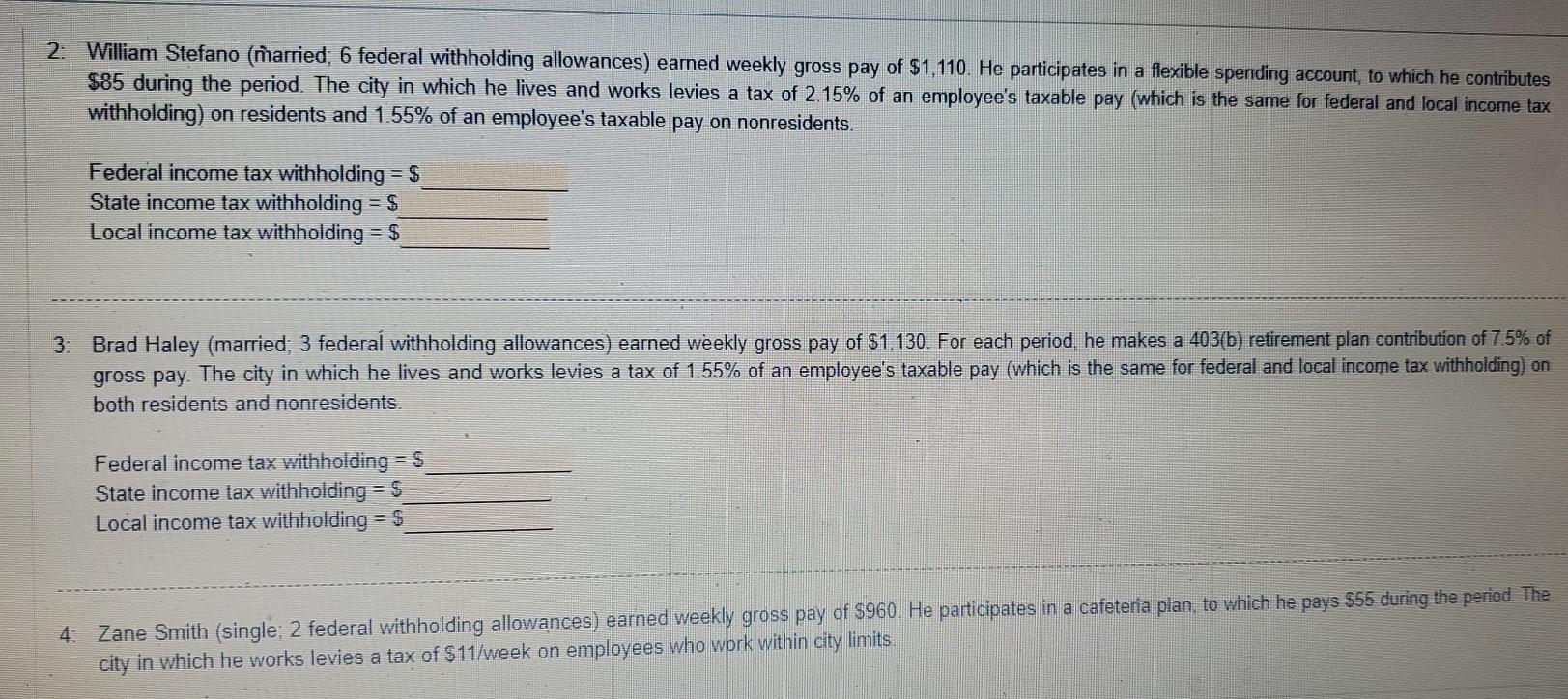

How To Calculate Local Income Tax Steps More

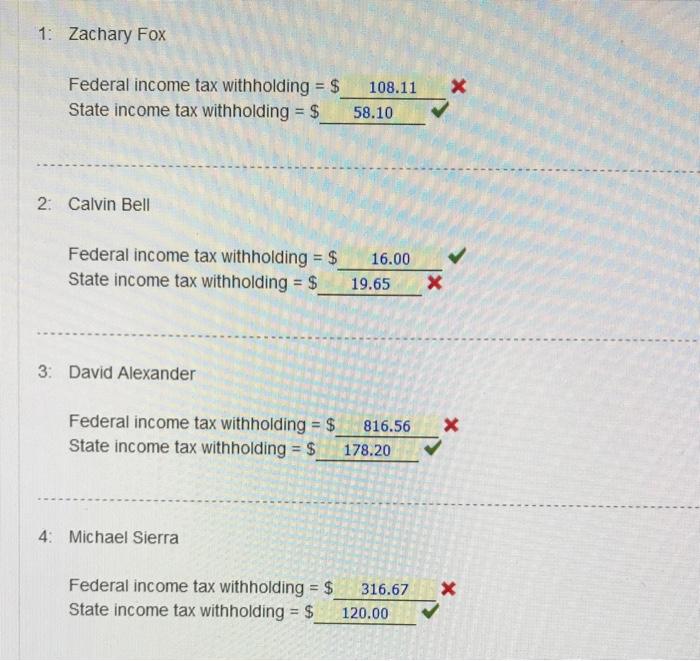

Solved Calculate Federal And State Income Tax Withholding Chegg Com

Tax Withholding Definition When And How To Adjust Irs Tax Withholding Bankrate

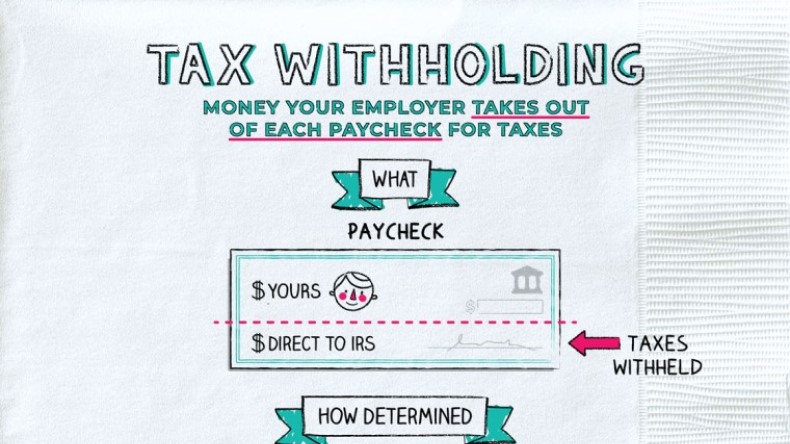

What Is Tax Withholding All Your Questions Answered By Napkin Finance

:max_bytes(150000):strip_icc()/GettyImages-498335019-569d0f595f9b58eba4abf4dc.jpg)

How To Calculate Withholding And Deductions From Employee Paychecks

Solved What Is The Purpose Of Extra Withholding Under The State Section Of The Employee Taxes

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W 4 Form How To Fill It Out In 2022

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

Solved Psc 3 8 Calculate Federal Wage Bracket Method Chegg Com

W 4 Form What It Is How To Fill It Out Nerdwallet

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

How To Calculate Withholding Tax As An Employer Or Employee Ams Payroll